Fetching stock data is essential for financial analysis, algorithmic trading, and stock performance tracking. Yahoo Finance provides a reliable and easy-to-use data retrieval mechanism through the yfinance Python library, simplifying the process of fetching historical stock information. This tutorial demonstrates how to fetch and analyze stock data, empowering you to build financial models, track performance, and conduct analysis.

Setting Up the Environment

Before diving into the code, ensure you have the necessary Python libraries installed:

pip install yfinance pandas matplotlib

These libraries help retrieve data, perform data manipulation, and create visualizations.

Fetching Stock Data

Here's a Python script to fetch historical stock data:

import yfinance as yf

import pandas as pd

from datetime import datetime

# Fetch stock data from Yahoo Finance

def get_stock_data(stock_symbol, period='1mo'):

"""

Fetch historical stock data for a given stock symbol and period.

:param stock_symbol: The ticker symbol of the stock (e.g., 'TATAMOTORS.NS').

:param period: The period for which to fetch data (default is '1mo').

:return: A DataFrame containing Date, Open, and Close price.

"""

try:

# Fetch data using yfinance

stock_data = yf.download(stock_symbol, period=period, interval='1d')

if stock_data.empty:

raise ValueError(f"No data found for {stock_symbol}.")

except Exception as e:

print(f"Error fetching data for {stock_symbol}: {e}")

return pd.DataFrame()

# Reset index to include Date as a column

stock_data.reset_index(inplace=True)

# Remove timezone information from 'Date' column if it exists

if 'Date' in stock_data.columns and pd.api.types.is_datetime64_any_dtype(stock_data['Date']) and stock_data['Date'].dt.tz is not None:

stock_data['Date'] = stock_data['Date'].dt.tz_localize(None)

# Define required columns

needed_cols = [('Date', ''), ('Open', stock_symbol), ('Close', stock_symbol)]

present_cols = [col for col in needed_cols if col in stock_data.columns]

if len(present_cols) < 3:

print("Warning: Not all required columns are available.")

return stock_data[present_cols]

# Return a DataFrame with only the required columns

return stock_data[[('Date', ''), ('Open', stock_symbol), ('Close', stock_symbol)]]

# Main function

def main():

"""

Main function to interact with the user, fetch stock data,

and display/save it in a readable format.

"""

# Input prompts for stock symbol and period

stock_symbol = input("Enter stock symbol (e.g., 'TATAMOTORS.NS'): ").strip()

period = input("Enter period (e.g., '1mo', '6mo', '1y'): ").strip()

# Validate period input

valid_periods = ['1d', '5d', '1mo', '3mo', '6mo', '1y', '2y', '5y', '10y', 'ytd', 'max']

if period not in valid_periods:

print(f"Invalid period. Please choose from: {', '.join(valid_periods)}")

return

print(f"\nFetching stock data for {stock_symbol} for the last {period}...\n")

stock_data = get_stock_data(stock_symbol, period=period)

# Handle empty DataFrame

if stock_data.empty:

print(f"No data available for {stock_symbol}. Ensure the stock symbol is correct and try again.")

return

# Rename columns for simplicity

stock_data.columns = ['Date', 'Open', 'Close']

# Display the stock data

pd.set_option("display.max_rows", None)

pd.set_option("display.max_columns", None)

print("\n=== Full Historical Stock Data ===\n")

print(stock_data.to_string(index=False, col_space=15))

print("\n==================================\n")

# Save the data to a CSV file

current_date = datetime.now().strftime("%Y-%m-%d")

file_name = f"{stock_symbol.replace('.', '-')}_{period}_{current_date}.csv"

stock_data.to_csv(file_name, index=False)

print(f"Data saved to '{file_name}'")

# Run the main function

if __name__ == "__main__":

main()

Example Output:

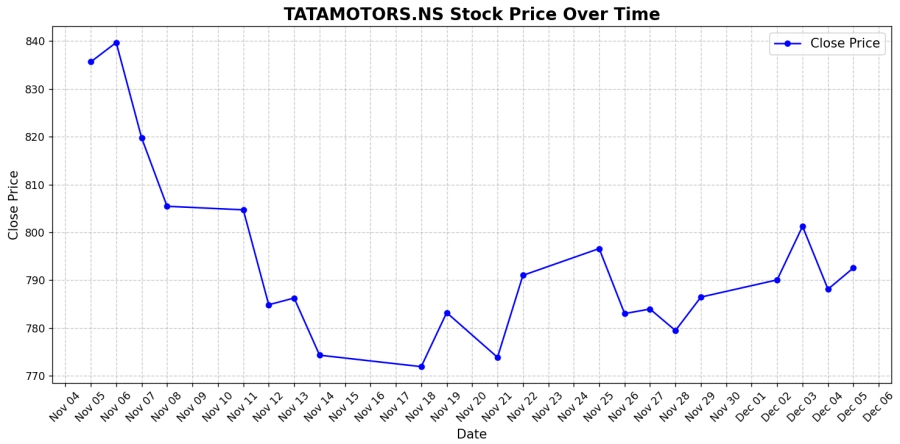

For the stock symbol TATAMOTORS.NS over the last 1 month:

Enter stock symbol (e.g., 'TATAMOTORS.NS'): TATAMOTORS.NS

Enter period (e.g., '1mo', '6mo', '1y'): 1mo

Fetching stock data for TATAMOTORS.NS for the last 1mo...

[*********************100%***********************] 1 of 1 completed

=== Full Historical Stock Data ===

Date Open Close

2024-11-05 821.500000 835.650024

2024-11-06 843.900024 839.700012

2024-11-07 841.000000 819.750000

2024-11-08 821.950012 805.450012

2024-11-11 801.000000 804.700012

2024-11-12 806.000000 784.849976

2024-11-13 787.000000 786.250000

2024-11-14 786.599976 774.299988

2024-11-18 778.000000 771.900024

2024-11-19 771.900024 783.200012

2024-11-21 784.950012 773.849976

2024-11-22 775.000000 791.000000

2024-11-25 808.049988 796.599976

2024-11-26 797.150024 783.000000

2024-11-27 785.049988 783.950012

2024-11-28 783.000000 779.450012

2024-11-29 779.500000 786.450012

2024-12-02 787.299988 790.049988

2024-12-03 795.000000 801.250000

2024-12-04 805.000000 788.099976

2024-12-05 793.000000 792.549988

==================================

Data saved to 'TATAMOTORS-NS_1mo_2024-12-05.csv'Visualizing Stock Trends

Use the matplotlib library to visualize stock data, particularly the closing prices:

def plot_stock_data(stock_data, stock_symbol):

"""

Plots the stock's closing price over time with all dates displayed on the x-axis.

Parameters:

stock_data (pd.DataFrame): DataFrame containing stock data with 'Date' and 'Close' columns.

stock_symbol (str): The ticker symbol of the stock.

"""

# Convert Date column to datetime if not already

if not pd.api.types.is_datetime64_any_dtype(stock_data['Date']):

stock_data['Date'] = pd.to_datetime(stock_data['Date'])

plt.figure(figsize=(12, 6)) # Larger figure for better visibility

plt.plot(

stock_data['Date'],

stock_data['Close'],

label='Close Price',

marker='o',

linestyle='-',

color='blue',

markersize=5

)

# Setting up the x-axis to display all dates

plt.gca().xaxis.set_major_locator(mdates.DayLocator()) # Major ticks for every day

plt.gca().xaxis.set_major_formatter(mdates.DateFormatter('%b %d')) # Format date as 'Month Day'

plt.title(f'{stock_symbol} Stock Price Over Time', fontsize=16, fontweight='bold')

plt.xlabel('Date', fontsize=12)

plt.ylabel('Close Price', fontsize=12)

# Customizing grid for better visual clarity

plt.grid(visible=True, linestyle='--', alpha=0.7)

plt.legend(fontsize=12)

plt.xticks(rotation=45, fontsize=10) # Rotate and resize x-axis labels for better readability

plt.yticks(fontsize=10)

# Show plot with tight layout for better spacing

plt.tight_layout()

plt.show()Call this function after fetching the data:

plot_stock_data(stock_data, stock_symbol)Output:

Customization Options

- Adjusting Columns: Include High, Low, and Volume data for detailed analysis:

stock_data[['Date', 'Open', 'High', 'Low', 'Close', 'Volume']] - Change Timeframe: Modify the

periodparameter (e.g.,1d,5y) to analyze different time intervals. - Additional Stock Symbols: Use tickers like

AAPL,MSFT,TSLA, or^GSPCfor indices like the S&P 500.

Conclusion

This tutorial introduced you to fetching and analyzing stock data using Yahoo Finance's yfinance library. By following these steps, you can customize your Python scripts for various financial analyses, create visualizations, and build predictive models. Try experimenting with different stock symbols, intervals, and data columns to broaden your understanding and capabilities.